Blog

For Investors

Are you planning to buy a property in Gujarat? If so, you need to be aware of the stamp duty and registration charges associated with the purchase. It is essential to understand these charges. It helps you avoid surprises and ensures a smooth property deal.

In Gujarat, stamp duty is a tax levied on property transfer. Registration charges constitute legal property registration fees. The charges vary by the property’s location, type, and value. They are a percentage of the property’s market value.

For instance, stamp duty rates in Gujarat range from 3.50% for rural areas to 7.5% for urban areas. Additionally, registration charges generally amount to 1% of the property’s market value.

These charges may change. It’s best to consult a legal professional or check the latest regulations.

Understanding stamp duty and registration charges in Gujarat will help you plan. It will help you budget. It will also help you budget and make informed decisions while buying property in the region.

Stamp duty is a tax. For example, property transactions in the Indian state of Gujarat. The state government imposes this tax. It is a percentage of the property’s market value. Stamp duty has two main goals. It raises money for the government and puts all property deals on record.

In Gujarat, stamp duty is an essential component of any property purchase or sale. Buyers must pay this fee to legally register the property in their name. The stamp duty rates in Gujarat vary by the property’s location. Higher rates apply to urban properties than rural ones.

Understanding the stamp duty charges is key. Anyone planning to buy a property in Gujarat must know them. Not paying the right stamp duty can lead to legal issues. It can also cause delays in property registration. So, buyers should learn the stamp duty rules in Gujarat. They should do this before buying a property.

Stamp duty is a tax mandated by the Gujarat government that applies to property transactions. It’s essentially a mandatory payment calculated as a percentage of the property’s market value. Think of it as a contribution to the state treasury to facilitate the legal transfer of ownership.

The amount of stamp duty payable depends on several factors:

Important Note: It’s crucial to rely on the property’s current market value for calculating stamp duty, not the agreement value mentioned in the sale deed.

Registration charges are additional fees paid to register the property with the government authorities. This registration process officially documents the transfer of ownership from the seller to the buyer. These charges are also calculated as a percentage of the property’s market value.

In Gujarat, property registration charges consist mainly of stamp duty and registration fees. The stamp duty in Gujarat is currently set at 3.05% of the property’s market value or the agreement value, whichever is higher. Additionally, there is a surcharge of 1% added to the stamp duty, making the effective rate 5.9%.

The registration fee in Gujarat is typically 1% of the property’s market value or the agreement value, with a maximum cap of ₹30,000.

To illustrate, if you’re purchasing a property in Gujarat valued at ₹50,00,000, the stamp duty would be ₹2,45,000 (4.9% of ₹50,00,000) and the surcharge would be ₹50,000 (1% of ₹50,00,000), totaling ₹2,95,000. The registration fee would be ₹30,000 (capped at this amount), making the total registration charges ₹3,25,000.

These charges are essential to consider when budgeting for a property purchase in Gujarat. For more detailed and updated information, always consult with local authorities or legal advisors. Visit Housivity for comprehensive guides and resources on property transactions in Gujarat.

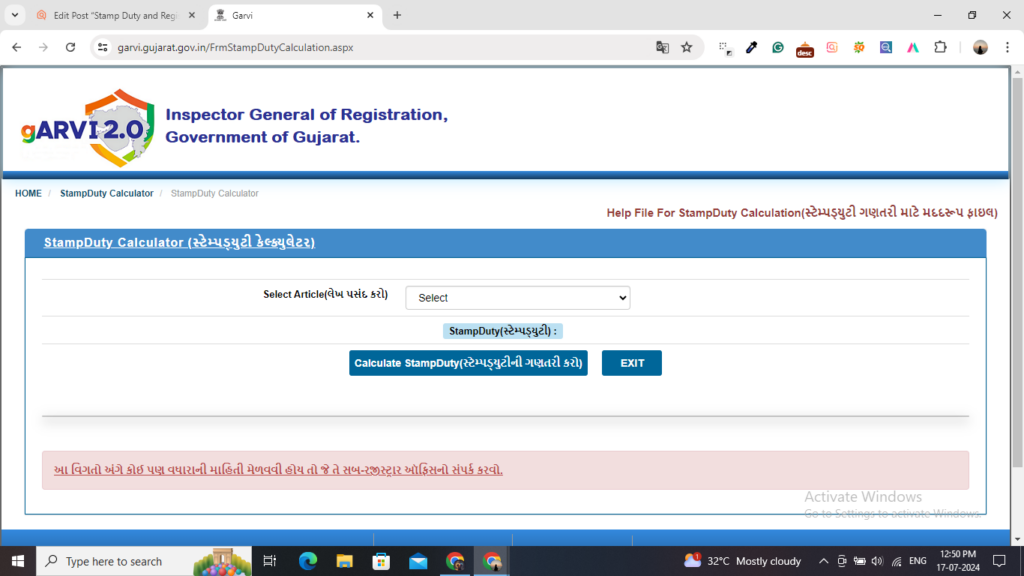

You can use the online StampDuty Calculator (સ્ટેમ્પડ્યુટી કેલ્ક્યુલેટર) on the Gujarat online portal.

Select the article for which stamp duty has to be calculated and click on calculate stamp duty.

Illustrated below an example

Suppose that Kartik Prajapati bought a property for Rs 90.75 lakh in Gujarat. The stamp duty he needs to pay comes to Rs 444675.

Calculation: 90,75,000 x 4.9/100 = Rs 444675.

Stamp duty charges are the same for men and women in Gujarat.

In Gujarat, officials calculate stamp duty based on the market value of the property. The stamp duty rate is a percentage of the property’s market value. The value is set by the government’s ready reckoner rates. They use the higher of those or the actual transaction value.

The stamp duty rates in Gujarat range from 4% to 7.5%, depending on the location of the property. For rural properties, the stamp duty rate is 4%. For urban properties, the rate can be as high as 7.5%.

Buyers calculate stamp duty. They do this by multiplying the property’s value by the duty rate. For example, if the property’s market value is Rs. 50 lakh and the stamp duty rate is 6%, the stamp duty payable would be Rs. 3 lakh (50 lakh x 6%).

Here’s a breakdown of the current stamp duty and registration charges applicable in Gujarat for the year 2024:

Example:

Let’s consider a scenario where you’re purchasing a property in Gujarat with a market value of ₹50 lakh.

In Gujarat, the registration charges consist of both stamp duty and the registration fee. The registration fee is generally 1% of the market value of the property or the agreement value, whichever is higher, subject to a ₹30,000 cap.

For example, if you buy a property worth ₹50 lakh:

Thus, the total cost for registration would be ₹2,45,000 (stamp duty) + ₹30,000 (registration charges) = ₹2,75,000 for a female buyer. For male buyers, the total would be ₹2,95,000.

Key Takeaway: This example highlights the gender disparity in registration charges. As of 2024, the Gujarat government offers a concession by waiving registration charges for female buyers.

It’s important to note that stamp duty and registration charges can change over time. Here’s a brief comparison with previous years (information not guaranteed):

Remember: For the most accurate and up-to-date information, it’s always recommended to refer to official government websites or consult with a qualified lawyer specializing in property transactions.

Understanding stamp duty and registration charges offers several advantages to property buyers in Gujarat:

Financial Planning and Budgeting

By being aware of these mandatory charges, you can factor them into your overall property budget. This helps ensure you have sufficient funds available to cover the total cost of acquiring the property, preventing any last-minute financial hurdles.

Property Investment Strategies

Understanding these costs allows for a more informed approach to property investment decisions. You can factor these charges into your calculations when evaluating potential returns on investment (ROI) for different properties.

Download stamp duty in Gujarat pdf

Failing to comply with stamp duty and registration regulations can result in various negative consequences:

Payment Methods and Procedures

There are several ways to pay stamp duty and registration charges in Gujarat:

Important Note: The specific payment methods and procedures may vary depending on the location within Gujarat. It’s advisable to consult with the local revenue authorities or a property lawyer for the most current information and guidance on the preferred payment method in your area.

The Gujarat government is actively promoting online payment facilities for stamp duty and registration charges. Here are some potential benefits of using online payment:

It’s important to note that online payment facilities might be subject to additional transaction fees in some cases.

Here are some common misconceptions regarding stamp duty and registration charges in Gujarat:

Here are some additional points to address potential doubts and queries:

Also check out: What is the Ready Reckoner Rate? Meaning, Calculation & Importance!

Understanding stamp duty and registration charges in Gujarat is important. But, buyers often have several common misconceptions about them.

Many people think that stamp duty and registration charges are the same for all properties. As mentioned earlier, the charges vary based on the property’s location. They depend on its type and value.

Another misconception is that the stamp duty and registration charges are negotiable. However, these charges are fixed by the government and cannot be negotiated.

Some buyers think skipping property registration will save them money. They think they can avoid stamp duty and registration fees. However, this is illegal and can lead to serious legal consequences.

In conclusion, understanding stamp duty and registration charges is crucial. If you plan to buy a property in Gujarat, you need to know about them. You must pay these charges. They can greatly raise the property’s cost.

The key takeaways from this article are:

By understanding these fees and planning accordingly. Buyers in Gujarat can ensure a smooth, hassle-free property transaction.

Subscribe now and be the first to receive insights that matter.